The Best Forex Prop Firms

The straightforward way to reviewing and comparing Forex Prop Firms in 2026.

Reliable, Independent, Fact-Checked Reviews

At Propfirmforex, the goal is simple: Provide honest, clear, useful data on the leading prop firms so you can make smarter decisions. Everything here is built to help traders understand the finer details that drive each firm, from rules, payouts, costs, platform options, and edge cases that catch people out.

“Forex prop firms” refers to prop trading firms that are primarily forex-focused in their structure and branding, but still offer traders the flexibility to explore multiple markets, with many providing access to futures, indices, commodities, and cryptocurrencies.

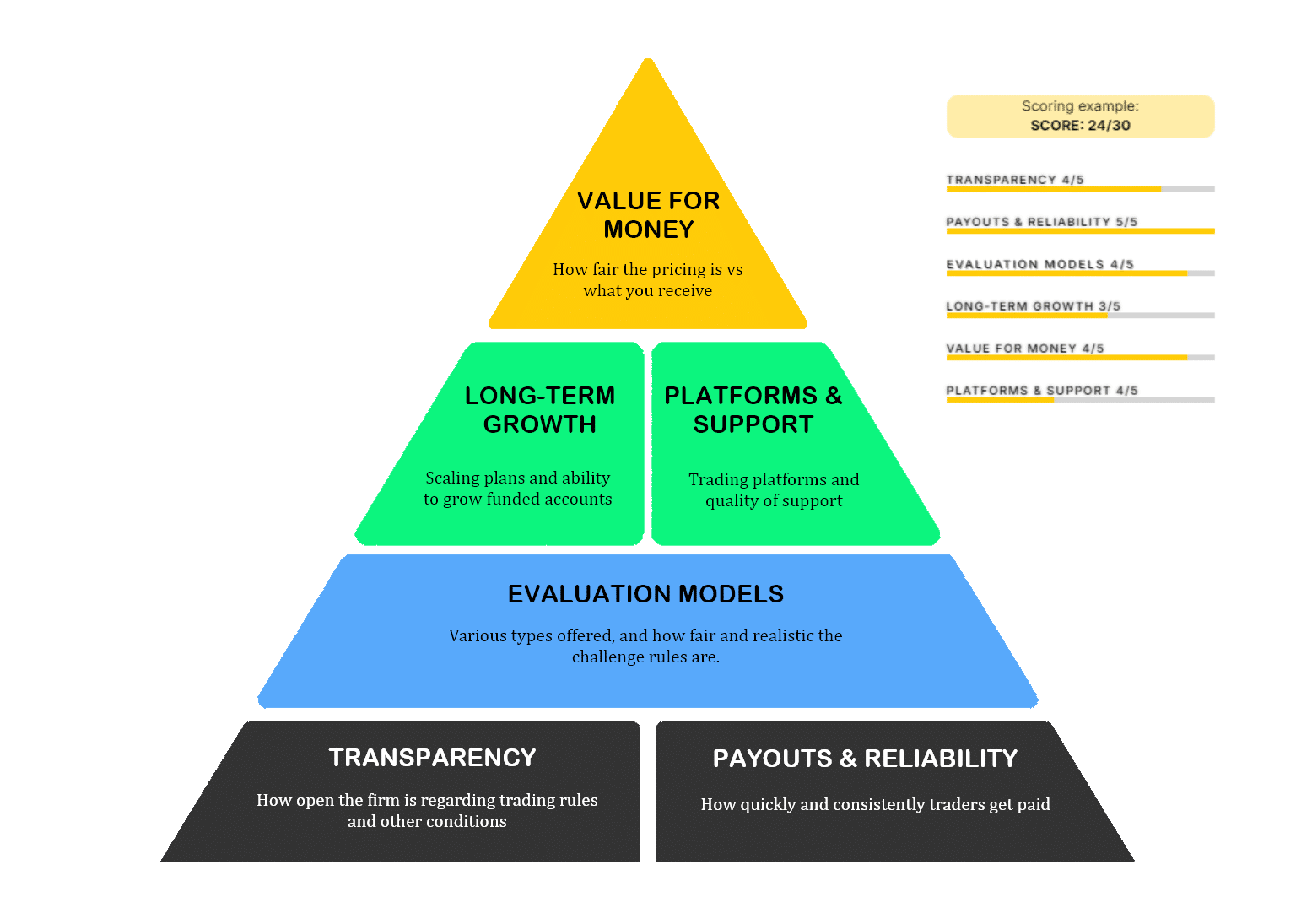

Methodology

Every review is structured around six key categories that define a trustworthy and reputable prop firm. Each category is given a score from 1-5, then totalled for an overall score of 30. This keeps things fair, consistent, and easy to understand. See the full breakdown for how each category is scored here.

What Are Prop Trading Firms?

Prop trading, short for proprietary trading, is when a firm provides you with capital to trade and you share the profits you generate. The big benefit is that you’re not risking your own money, and instead, you’re trading with the firm’s capital. Because the firm’s success largely depends on your performance, they will give you access to reliable platforms, useful tools, and support to help you trade more effectively. The more profit you make, the more both you and the firm stand to gain.

Each prop firm has its own programs and rules. Funding amounts can vary, as do the evaluation steps designed to test your skills and trading discipline. They also set risk management requirements to protect their capital, since they’re the ones covering any losses.

Prop trading firms generally fall into one of two primary categories:

Broker-Backed

Prop firms backed by established brokers tend to be the most dependable in the industry. They operate within regulated environments, offer direct access to the markets, and maintain competitive cost structures. Broker-backed firms rely less on challenge fees alone and more on a hybrid model of brokerage revenue (spreads and commissions) and trader performance (profit share).

These firms can provide high quality trading platforms, tight spreads, low commissions, and transparent information about fees, rules, and how their evaluation programs work.

Independent

Independent prop firms operate without broker partnerships and many run on simulated trading environments. Their income often comes from challenge fees and profit splits instead of direct market trading. With fewer regulatory restrictions, they can offer lower fees or aggressive scaling plans, making them attractive to traders.

Fewer regulatory restrictions also means transparency can vary. Some firms are less clear about their fees or operations, so it’s important to research each firm before committing.

Would You Pass a Prop Firm Challenge?

Take a quick self-assessment to see how closely your trading habits and mindset align with typical prop firm requirements, and get an idea of how likely you are to pass an evaluation and move on to a funded account.

Best Broker-Backed Forex Prop Firms

Score: 27/30

Profit Payout

80% – 95%

Evaluation Models

One/Two Step

Max Funding

$200,000¹

Payout Methods

Crypto, Confirmo, RiseWorks

Payout Frequency

Fortnightly²

Trading Platforms

MetaTrader 4/5, cTrader, Match Trader

¹ Max allocation prior to scaling

² First payout after 28 days, then every 2 weeks

Best for experienced CFD traders seeking no time limits, weekend/overnight holding, 24-hour payouts, and add-ons that can lift splits to 95% (after passing). Not ideal if you dislike static 3–5% daily loss or 6–10% overall balance loss rules, or need relaxed cross-owner copy-trading.

Score: 23/30

Profit Payout

80% – 90%

Challenge Types

One/Two-Phase, Rapid

Max Funding

$600,000¹

Payout Methods

Bank transfer, Crypto

Payout Frequency

Fortnightly²

Trading Platforms

TradeLocker and TradingView

¹ Max $200k for challenge phase

² Can be reduced to 7 days with booster addon for 20% fee (30% for Rapid)

Best for flexible traders comfortable with TradeLocker’s broad CFD lineup, with optional upgrades like weekly payouts, profit splits up to 90%, and no strict time limits on standard challenges. Not ideal if you require MT4/MT5 or more platform choice, dislike add-on models, or run high-volatility strategies that could hit daily profit caps.

Enter promo code PROPFIRMFOREX at signup and get 20% off fees on all challenge types

Score: 23/30

Profit Payout

80% – 90%

Evaluation Models

One/Two Step, Rapid, Instant

Max Funding

$200,000¹

Payout Methods

Crypto, RiseWorks

Payout Frequency

Fortnightly²

Trading Platforms

MetaTrader 4/5, DXTrade

¹ Max allocation prior to scaling

² Can be reduced to 7 days with addon for 20% fee

Best for traders with some experience who want to scale into larger funded accounts on a stable, broker-backed setup. Not ideal for complete beginners, those chasing ultra-high leverage or instant payouts, or anyone wanting to skip the evaluation entirely.

Enter promo code PROPFIRMFOREX at signup and get 20% off fees on all challenge types

Score: 23/30

Profit Payout

Up to 90%

Evaluation Models

One/Two/Three Phase

Max Funding

$200,000¹

Payout Methods

Crypto, RiseWorks

Payout Frequency

Weekly or Fortnightly

Trading Platforms

Platform 5, ThinkTrader + TradingView

¹ Max allocation prior to scaling

Best for disciplined intraday or swing traders comfortable with 3–4% daily risk limits who want TradingView-style charting via ThinkTrader or an MT5 raw-spread setup. Not ideal for Australian residents (blocked), pure news scalpers without the news add-on, or automation-heavy strategies without the EA add-on.

Score: 21/30

Profit Payout

Up to 90%

Evaluation Models

One/Two/Three Step, Lightning, Instant

Max Funding

$400,000

Payout Methods

Bank transfer, Credit Card, Crypto, Rise

Payout Frequency

Fortnightly¹

Trading Platforms

MetaTrader 4/5, DXTrade, TradingView

¹ Addon required for Three-Phase account to reduce from monthly to fortnightly

FXIFY suits experienced discretionary and EA traders who want on-demand first payouts and full platform choice across MT4, MT5, DXtrade, and TradingView. It’s less ideal if you need every evaluation number spelled out on the public site or if you’re sensitive to occasional rule or package tweaks.

Best Independent Forex Prop Firms

Score: 29/30

Profit Payout

80% – 90%

Evaluation Models

Two-Step

Max Funding

$400,000

Payout Methods

Bank transfer, Crypto, Skrill

Payout Frequency

Fortnightly

Trading Platforms

MetaTrader 4/5, DXTrade, eTrader

Best for experienced, rules-driven day or swing traders who can work within a 5% daily and 10% overall loss limit, want unlimited time to pass, and prefer mature platforms (MT4/MT5/cTrader/DXtrade). Not ideal if you need to hold through macro news/weekends on high leverage (use Swing at 1:30 instead) or expect lax enforcement on copy-everything “gaming” strategies.

Score: 29/30

Profit Payout

Up to 100%

Evaluation Models

One/Two/Three Step, Instant

Max Funding

$250,000

Payout Methods

Bank transfer, Crypto, RiseWorks

Payout Frequency

Monthly

Trading Platforms

MetaTrader 4/5, cTrader

Best for steady, risk-aware traders who want long evaluation windows, conservative risk rules, and clear scaling paths to larger capital. Not ideal if you need ultra-high leverage, very fast payout cycles, or relaxed rules around news/copy trading.

Score: 26/30

Profit Payout

80% – 90%

Evaluation Models

One/Two Step, Instant

Max Funding

$200,000¹

Payout Methods

Bank transfer, Crypto, RiseWorks

Payout Frequency

Fortnightly

Trading Platforms

MetaTrader 5, cTrader, DXTrade

Best for experienced, disciplined traders who want flexible one or two-phase evaluations, clear risk rules, fast payouts, and straightforward scaling. Not ideal if you require ultra high leverage, hands-off copy/automation without specific add-ons, or dislike static daily/overall loss limits.

Blog Posts

Disclaimer

The content provided here is for general information purposes only. While there are countless resources available online, it’s essential to be cautious, as misinformation is also widespread. Be discerning when evaluating forex resources from unverified sources, as not all providers prioritize your best interests. Users should exercise caution and conduct their own research before making any decisions based on the information provided on this website. I am not responsible for any consequences or losses that may arise from the use of the information provided. All product names, logos, and brands are property of their respective owners. All company, product, and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement.