FXIFY Review

FXIFY has been operating since 2023, and it’s headquartered in Labuan, Malaysia, with a UK office handling data and payments. The firm publicly lists its Labuan money-broker licence and London address in its docs.

It’s best known for on-demand first payouts and broad platform choice, including TradingView via its Alchemy Markets integration.

Reviewed by: Adam Niven

Fact-checked: January 2026

Snapshot (TL;DR)

FXIFY is a solid pick if you want fast cashflow, with the first payout available on demand (minimum 50 USD) and flexible platforms like MT4, MT5, DXtrade and TradingView. Expect moderate leverage at 30:1 with an optional 50:1 upgrade for FX and Gold, biweekly payouts after the first, and clear crypto tracks with 3 percent daily and 6 percent trailing risk. Note that some CFD drawdown percentages only appear at checkout.

Best for:

Experienced discretionary or EA traders who want on-demand first payouts and MT4/MT5/DXtrade/TradingView access, and who don’t mind that some rule text (drawdown figures for evaluations) isn’t published as plainly as peers.

Not for:

Traders who require fully transparent, numerically explicit evaluation DD/targets on the public site before purchase, or those who dislike occasional rule/package changes.

PROS:

On demand first payout

Your first withdrawal is available as soon as you close your first live trade, with a minimum of 50 USD and no minimum days or targets for that first cashout.

Strong platform lineup

Trade on MT4, MT5, DXtrade and TradingView. TradingView access is enabled through an Alchemy Markets integration that lets you place trades directly from TradingView.

Clear crypto funding tracks

Crypto programs publish a 3 percent daily risk limit and a 6 percent trailing maximum loss, with payout splits up to 100 percent on eligible plans.

CONS:

Scattered rule details

Overall drawdown percentages for CFD programs are not plainly listed on public pages and often appear only in the dashboard or checkout. Third party summaries can conflict with current pages.

Conservative leverage

Standard leverage is 30:1 with an optional 50:1 upgrade for FX and Gold. Indices, oil and stocks are lower, so very high beta strategies may feel constrained.

Conflicting summaries around Lightning

The official Lightning page lists one step, 5 percent target and 7 days to pass. Some third party writeups add extra risk rules and a 30 percent consistency filter that are not shown on the current official page.

|

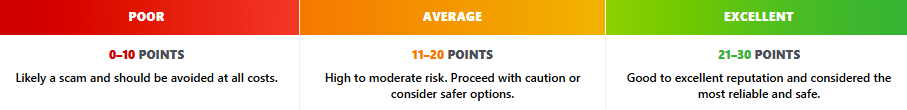

Transparency & Reputation

Publishes licence/payment-agent details and positions as broker-backed. Young brand but clear disclosures.

|

4 |

|

Payouts & Reliability

First payout on demand with a 50 USD minimum; regular cycles after. Growing but shorter track record than legacy peers.

|

4 |

|

Evaluation Models

Solid mix (1/2/3-phase, Lightning, crypto), some CFD drawdown figures aren’t centralized on public pages.

|

3 |

|

Long-Term Growth

Scaling available and widely referenced, although thresholds and caps aren’t consolidated publicly.

|

3 |

|

Value for Money

Refundable eval fees and frequent promos improve effective cost. Exact fee grids vary by size/add-ons.

|

3 |

|

Platforms & Support

Refundable eval fees and frequent promos improve effective cost. Exact fee grids vary by size/add-ons.

|

4 |

See Methodology page for the full breakdown of how each category is scored.

FX-first platforms and tools

Trade majors, minors and exotics on MT4, MT5, TradingView and DXtrade, so your FX workflow, indicators and templates carry over without friction.

On-Demand First Payout

Request your first withdrawal as soon as you start trading a funded account, with a 50 USD minimum and no extra day or target requirements for that first cashout.

Practical leverage for currencies

Standard leverage is 30:1 with an optional 50:1 upgrade for FX and Gold, giving room to size positions while keeping risk predictable.

Trade through news and weekends

News trading and weekend holding are allowed, which suits FX swing and event-driven strategies that span sessions.

Challenges & Accounts

1/2/3-Phase Evaluations

FXIFY offers the standard one, two, and three-phase challenges with optional add-ons. You can bump leverage to 1:50, switch to biweekly payouts, and push the split to 90%. The site explains the structure and platforms but doesn’t publish the exact profit targets or drawdown numbers. That’s less transparent than many rivals.

Time limits and first payout

You get unlimited time to pass. The “Fast Payouts” page says your first payout can be requested after your first funded trade with no minimum days. Some program pages mention a 50 USD minimum and five minimum trading days. That’s a conflict. Double-check in chat or the dashboard before you buy.

Add-ons

Leverage upgrade to 1:50, biweekly payout add-on, and profit split up to 90%.

Drawdown basics

-

Daily (static): A set percent of your starting balance you can lose in one day. It resets the next day.

-

Trailing: Moves up with your equity high-water mark. If trailing is 6% and you peak at 105,000, the floor is 98,700 until you make a new high.

FXIFY offers both styles. Since the exact percentages aren’t posted, confirm the numbers for your program and size at checkout or with support.

Lightning Challenge

One step, 5% target, seven days to pass, then funding. EAs and copy trading are restricted, so check details if you rely on them.

Instant Funding

No evaluation. You trade right away. Payouts run on a 14-day cycle. Marketing mentions “instant” but the schedule is every two weeks, so set expectations accordingly.

Crypto Programs

Clear rules for crypto: 3% daily drawdown, 6% trailing overall, 25% consistency, and seven minimum trading days. Profit split can reach 100% depending on the plan. If you mainly trade crypto, this section is the most transparent.

Trading Platforms

MT4 and MT5 are available along with DXtrade. In October 2025 FXIFY introduced TradingView execution through a partnership with Alchemy Markets. Press and industry coverage note that users can open, manage and close trades directly inside TradingView using FXIFY credentials, which reduces context switching. This is a meaningful quality of life feature for discretionary traders with TradingView centric workflows

Scaling Plan

FXIFY’s scaling program is for evaluation-funded accounts and is designed to grow your capital as you prove consistency. Traders are reviewed roughly every three months, and the common bar is about 10 percent total profit with at least two of those months positive. Meet the mark and your account steps up in size on a set schedule, with growth continuing toward an advertised cap around 4 million. Instant Funding typically does not participate, so be sure to check your dashboard for the exact rules tied to your plan.

Trading Rules

FXIFY sets clear rules to keep risk in check while letting you run your playbook.

News trading

Rules depend on the account. Instant Funding and Lightning require a five-minute buffer before and after news. Other accounts have no news restriction.

Automated trading

EAs are allowed on MT4 and MT5. They are not allowed on DXtrade or on Lightning accounts.

Copy trading

You can copy between your own FXIFY accounts. Third-party copying needs a verified master account statement.

Risk management

Lightning requires a stop loss on every trade.

Prohibited strategies

No HFT, latency arbitrage, tick scalping, or account sharing.

Weekends and holding

You can hold over the weekend and trade through news on all accounts except Lightning, which has limits on both.

Payouts and Reliability

First payout and cadence

FXIFY’s main marketing theme is speed. The firm states you can request your first payout on demand after closing your first live trade. The Three Phase program page confirms a minimum amount of 50 USD for that first withdrawal. After the first cashout the cadence is biweekly for most accounts. The Three Phase page also shows a monthly default with a biweekly add on option. Instant Funding uses a first 14 day window and then continues on a 14 day cycle.

Methods and processors

Rise requires KYC for anyone paying or getting paid on the platform. Community documentation for FXIFY’s payout process walks traders through completing Rise KYC and then requesting the payout from the FXIFY dashboard. Expect the same if you choose bank wire in a region where Rise is not supported.

Fees and refunds

Public pages and third party overviews show teaser pricing and frequent promotions. FXIFY markets fee reimbursement with your first payout for evaluation paths. That means your initial assessment fee is refunded once you reach the first withdrawal. The exact fee and the presence of promotions vary, so treat the checkout as the source of truth for your chosen size.

Commission Fees

FXIFY gives you two pricing choices. Go raw with spreads from 0 pips and a $6 round-turn per lot on FX, metals, crypto and indices, powered by FXPIG’s feed. You’ll often see the tightest pricing on pairs like EUR/USD and XAU/USD during London and New York peaks, while spreads can widen a bit in quieter hours. If you prefer simplicity, pick the all-in feed with no commission. They don’t publish average spreads, so it’s smart to test a demo during your usual session. One catch for now is the lack of swap-free accounts, though they’ve said it’s on the roadmap.

Payment Methods

-

Major cards – Visa, Mastercard and American Express are accepted through FXIFY’s checkout.

- Other methods – FXIFY’s General T&Cs say you can pay by “a payment card or other means of payment that the Provider currently offers on the Website.” In practice that covers whatever shows at checkout during your purchase window.

Notes from public comms – FXIFY’s official social posts have also mentioned PayPal and crypto alongside card processing. Treat these as situational and confirm at checkout.

Community and Trust

Channels

Support is available through the site chat and email. An active community presence exists across review sites and social channels. Response times are described as fast in many writeups, although this is anecdotal.

What traders talk about

The most common topics are payout timing, Rise KYC steps and leverage settings on specific instruments. There are occasional complaints about KYC rejections with Rise across multiple firms, which is consistent with standard compliance practice in payment processors. These items are not unique to FXIFY but are part of the operational reality when a firm uses third party payout rails.

FXIFY Leadership

Bobby Winters is the co-founder of FXIFY and also serves as the CEO of its parent company, FXPIG. The leadership team also includes co-founders Peter Brown and David Bhidey, bringing over 30 years of collective trading and brokerage experience to the firm.

Alternatives

FTMO

Choose FTMO if you want a long standing brand with a classic two step model and are comfortable with a first payout that is not on demand. This is a calmer rule set for traders who do not need TradingView execution. (Source for comparison context is FXIFY’s own payout positioning).

E8 Markets

Choose E8 if you prefer frequent promotions and are fine with a more traditional first payout window after funding. FXIFY differentiates on the first cashout and the TradingView integration.

Alpha Capital Group

Choose ACG if you want straightforward operations with a smaller menu of programs, accepting that first payouts are not on demand. FXIFY’s positioning makes this contrast clear.

Bottom Line

FXIFY’s edge is speed to cash and platform flexibility. The first withdrawal on demand at a 50 USD minimum, the biweekly cadence after that and the TradingView integration will appeal to traders who want to turn performance into cash quickly. The crypto programs have clearly written 3 percent daily and 6 percent trailing limits. The main gap is that some CFD program percentages are not centralized on a single public page, which means you must verify the exact values at purchase and inside the dashboard.

FAQs

Is the first payout really on demand and what is the minimum?

Yes. FXIFY’s payout pages state you can request your first withdrawal on demand after your first live trade. The Three Phase page lists a 50 USD minimum for that first payout.

How often are payouts after the first withdrawal?

Most plans run on a 14 day cycle after the initial cashout. The Three Phase page shows a monthly default that can be switched to 14 days with an add on. Instant Funding uses a first 14 day window.

What are the daily and overall drawdown numbers for CFD programs?

FXIFY uses a static daily loss approach on CFD paths but does not publish a single number across all plans. Third party sites often cite 3 to 5 percent daily and 5 to 10 percent overall. Use the dashboard and checkout values as your final reference.

What are the crypto rules?

Crypto Standard lists a 9 percent profit target with a 3 percent daily limit and a 6 percent trailing maximum. Crypto Instant uses the same 3 percent and 6 percent limits with a 7 day minimum before the first payout window.

Can I place trades directly from TradingView?

Yes. FXIFY added TradingView execution in October 2025 via Alchemy Markets and this lets you open, manage and close trades directly from TradingView.

What payout methods are available and is KYC required?

Payouts commonly use Rise with KYC required and bank wire where Rise is not supported. You complete KYC on the Rise site then submit the payout request from the FXIFY dashboard.

Are EAs, news trading and weekend holding allowed?

Yes across the standard CFD lineup according to FXIFY’s program materials. Always check your account specific rules in the dashboard.

Where is FXIFY headquartered and how long has it been operating?

The firm lists a Labuan, Malaysia licence and address and began operating in 2023. There is a UK presence for payments and operations.

Would You Pass a Prop Firm Challenge?

Take a quick self-assessment to see how closely your trading habits and mindset align with typical prop firm requirements, and get an idea of how likely you are to pass an evaluation and move on to a funded account.