The 5ers Review

The 5ers launched in 2016 and operates from Raanana, Israel, with an additional UK presence. The 5ers is one of the older retail prop firms still active, with extensive FAQs and excellent educational resources. The firm runs three programs: Hyper Growth (1-step), High Stakes (2-step), and Bootcamp (3-step), and supports MT5 and cTrader. It advertises scaling up to multi-million allocations, unlimited evaluation time on all tracks, and a maximum profit split up to 100% depending on program and growth level.

Reviewed by: Adam Niven

Fact-checked: January 2026

Snapshot (TL;DR)

The 5ers is a long-running prop with three clear tracks, simple risk rules, and a steady payout routine. If you like unlimited time and static loss limits, you’ll feel at home here. If you rely on trading right on top of major news, pay attention to the High Stakes rule that blocks order execution two minutes before and after those events.

Best for:

Experienced FX/indices traders with defined systems who want flexible holding rules, bi-weekly payouts, and either a classic 2-step (High Stakes) with higher leverage or a one-step pathway (Hyper Growth).

Not for:

News-scalpers who rely on bracket orders, copy-trade networks, or HFT/latency-arb algorithms – these are restricted or banned.

PROS:

Unlimited time to pass: Wait for A-setups; no deadline pressure.

Static (non-trailing) drawdowns: Equity highs don’t ratchet the stop-out line.

MT5 + cTrader support: Use the platform that fits your tools and workflow.

CONS:

News execution blackout (High Stakes): No orders from T-2 to T+2 minutes on major news.

Copy trading/EA restrictions: Trade copiers and latency/arb EAs risk violations.

Payout frictions: $150 minimum and 2-3% processing fees.

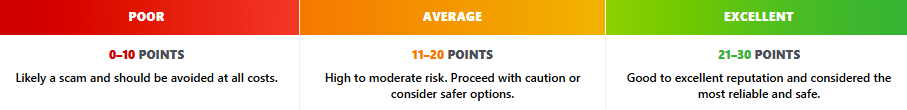

Scorecard

|

Transparency & Reputation

Program pages, Help Center, and T&Cs lay out rules clearly and are updated, which reduces “gotcha” risk. Longevity since 2016 adds stability points.

|

4 |

|

Payouts & Reliability

First payout after 14 days with documented methods shows operational maturity. The $150 minimum and method fees (~2–3%) are transparent but slightly reduce net payout.

|

4 |

|

Evaluation Models

Caters to most trader preferences, and all offer unlimited time. Static (non-trailing) overall drawdowns are friendlier for swing and trend strategies.

|

5 |

|

Long-Term Growth

Scaling paths and up-to-100% split create strong upside once consistent. Fixed-payout options and Hub Credits add flexibility for planning cash flow.

|

4 |

|

Value for Money

Bootcamp’s low upfront plus “pay remainder on success” is highly cost-efficient for testing fit. High Stakes fee refund at first payout improves effective acquisition cost.

|

5 |

|

Platforms & Support

MT5 and cTrader coverage suits both algo and discretionary users, and asset specs are reasonably detailed. 24/7 support claims and active help resources are positives.

|

4 |

Key Features

Unlimited Time to Pass

No countdown on Hyper Growth, High Stakes, or Bootcamp, so you can wait for A-setups instead of forcing trades.

Frequent Payouts

First payout at 14 days, then every 14 days, with Rise/crypto/bank/Hub Credits. In High Stakes your evaluation fee is refunded at the first payout.

Static Risk Limits

Daily and overall caps are fixed off the initial balance (e.g., High Stakes 5% daily / 10% overall), so equity highs don’t ratchet your stop-out.

Weekend/overnight Holding Allowed

You don’t need to close your trades on Friday, which is great for swing and macro setups.

Challenges & Accounts

Hyper Growth (1-step, quick path)

Think of this as the “single hurdle” track: hit +10% once, under a 3% daily pause and 6% overall max loss. Unlimited time. Once funded, you can earn from the first target and scale in increments. If you like clean static limits and want the fastest route to real payouts, this is the option.

High Stakes (2-step, classic challenge)

Two phases: +8% then +5%, 5% daily / 10% overall, 3 minimum profitable days per phase, unlimited time. First withdrawal every 14 days once funded; 80–100% split. Great if you like the structure of a two-step and want clear, static limits. Caveat: no order execution from 2 minutes before to 2 minutes after high-impact news.

Bootcamp (3-step, low upfront)

This is the “pay less now, prove more, scale later” track. Entry ~$95, three × 6% targets, 5% overall (no daily cap during evaluation), and unlimited time. Once funded, a 3% daily pause appears. Best for cost-sensitive traders who like to take their time.

Trading Platforms

You can trade MT5 or cTrader here. Both are fully supported. If you already have templates or custom tools in MT5, you can bring your indicators and EAs. If you live in cTrader, you can use cBots and enjoy the depth-of-market view and fast, clean order tickets.

-

MT5: The Hyper Growth and High Stakes pages list MT5 as the default platform. You get desktop, web, and mobile access. It’s the familiar path if you’ve built your workflow around MQL5 indicators and EAs.

-

cTrader: The Help Center has step-by-step guides for logging in to your cTrader account after purchase and for switching between multiple accounts. The firm publicly highlighted the cTrader rollout in 2025, and industry coverage noted this helped the firm support US traders again.

Which one should you pick?

-

Pick MT5 if you rely on an MT5-only EA or you like a big library of community indicators.

-

Pick cTrader if you prefer C# for automation, want native depth-of-market, or you felt limited by MT-style order tickets.

Either way, check the symbol list, commission model, and swaps for the instrument you trade most.

Scaling Plan Overview

All programs scale your funded account in steps as you hit performance targets. The firm advertises a ceiling up to about 4 million in capital across tracks.

Hyper Growth (1-step):

After you pass and get funded, each time you hit another 10% gain the account jumps to the next tier. The official page shows a ladder from 20k through 40k, 80k, 160k, 320k, 640k, then 1.28M, with splits improving toward 80–100% at the high tiers, and a headline cap shown at 4M. Example: on a 20k funded account, a +2,000 gain triggers a move to 40k.

High Stakes (2-step):

High Stakes uses the same general idea of scaling as you grow. The Help Center adds a perk once you reach bigger balances. Hit 350k and you become eligible for a fixed monthly payout of 4,000 that is credited to your account. Hit 500k and that fixed payout becomes 10,000. Those amounts are paid on your normal payout cycle.

Bootcamp (3-step):

Bootcamp marketing highlights scaling at smaller checkpoints. The page currently states “scale your account on every 5% target,” which means more frequent bumps as you progress, with the same long-run destination toward higher allocations.

Notes:

- You keep scaling as long as you respect the program’s risk rules, then request your payout on the normal 14-day cycle. Fixed paycheck eligibility is unique to High Stakes at the larger tiers.

- If you want the exact tier sizes and splits for your chosen program and starting balance, use the table on the specific program page. Hyper Growth publishes the most detailed step-by-step ladder publicly.

Trading Rules

All three programs advertise unlimited time. You can work through the phases at your own pace. Keep the account active though. The firm notes that inactivity can lead to problems, so do not let it sit for long stretches without a trade.

Minimum trading days and consistency

High Stakes asks for 3 profitable days per phase. That is the only formal consistency rule the firm highlights for that program. Hyper Growth and Bootcamp do not list a fixed minimum days count on their public overviews.

News trading

You can hold positions over news on all programs. High Stakes has a specific execution block. Do not place, close, or modify orders from two minutes before until two minutes after a high-impact event on their calendar reference. If you make money inside that window it can be removed. Losses still count. Plan your entries a little before or after.

Holding overnight and over the weekend

Holding is allowed. Be aware of financing. Index CFDs in particular can have noticeable swaps, and weekends can be more expensive. If you plan to hold through Friday to Monday, check the symbol’s swap line in the specs first.

Automation and prohibited practices

EAs are allowed with limits. The firm bans copy trading between accounts, trade coordination, latency and price-error arbitrage, and other exploitative methods. If you automate, use your own code and stay away from copier networks.

Payouts and Reliability

The mechanics are straightforward: first payout eligibility appears 14 days after the funded account is activated, and then ongoing every 14 days. Methods: Rise, crypto, bank transfer, or Hub Credits. Fees: ~2% on Rise/crypto, ~3% on bank; Hub Credits cost 0% but can only be used to buy programs (not cash out). Minimum withdrawal is $150. The kicker: in High Stakes, your evaluation fee is refundable at the first withdrawal.

Commission Fees

As of the latest Help Center update, FX commission is $4 per lot round trip, indices are $0 commission, and crypto/metals/oil use a % commission. Check the Asset Specifications page for current hours, margin, and swaps. Indices in particular have hefty swaps (and triple over weekends).

Payment Methods

Methods include Rise, bank transfer, and crypto. High Stakes adds a nice perk where your evaluation fee is refunded to your account and withdrawable at that first payout

Community and Trust

Trustpilot snapshot

-

Primary page: “the5ers.com” holds a 4.8 out of 5 rating with ~20k reviews, which is one of the larger review counts in the prop space. Recent comments highlight responsive support and on-time payouts.

-

Secondary page: There’s a smaller “5ers.com” listing with ~150 reviews and a rating shown around 4 stars. It appears to be a legacy or alternate domain entry and is far less representative than the main page.

What traders say:

-

Positive themes: frequent mentions of smooth withdrawals and helpful support. Several Reddit posts and comments describe passing High Stakes, getting funded, and receiving one or more payouts without drama.

-

Mixed/critical notes: scattered reports of slippage around fast markets and occasional disputes about “bulk trading” or execution patterns that tripped rules. These are individual threads, so take them as personal experiences, not universal outcomes.

-

Community presence: active Help Center articles and announcements, plus external posts about the cTrader rollout which many users saw as a positive step for platform choice and regional access.

Compared to Other Firms

FTMO vs The 5ers — Both now offer no time limits on evaluations. FTMO keeps the classic two-step with clear objectives and lets you trade news during the Challenge/Verification (restrictions mainly kick in on funded unless you choose Swing), while The 5ers’ comparable track (High Stakes) is also two-step but adds a strict ±2-minute news-execution blackout around high-impact events. If you rely on news entries, FTMO is looser; if you want static, non-trailing limits plus unlimited time, The 5ers is similar but stricter on news.

Funded Trading Plus vs The 5ers — FT+ also runs without time limits and supports multiple platforms; it’s positioned as flexible on strategy, including allowing news trading, which contrasts with The 5ers’ High Stakes news-execution window. If you want the broadest freedom around news and a wide platform mix, FT+ leans more permissive; The 5ers counters with very codified static risk limits and a mature help-center rulebook.

Blueberry Funded vs The 5ers — Blueberry Funded markets itself as broker-backed (Blueberry Markets) with no time limits and expanding product coverage (including stock CFDs), so it appeals if you value a broker lineage and instrument breadth. The 5ers, by comparison, emphasizes static risk, unlimited time, and a long operating history; its stricter High Stakes news rule is the main constraint you’ll feel that Blueberry doesn’t foreground.

Blueberry Funded Full Review >>

DNA Funded vs The 5ers — DNA highlights balance-based daily drawdown and documents trailing mechanisms in its materials; you’ll also see a 14-day first payout (with a 7-day “booster” option) in program PDFs. The 5ers’ flagship tracks use static (non-trailing) limits and a 14-day first payout as well, but The 5ers adds the High Stakes news-execution blackout. Choose DNA if you want balance-based/trailing dynamics; choose The 5ers if you prefer simple static limits and unlimited time with tighter news rules.

ThinkCapital vs The 5ers — ThinkCapital leans into its own stack (ThinkTrader with TradingView integration) and up-to-90% profit-split marketing, but it explicitly bans news trading across challenge and funded, a harder restriction than The 5ers (which allows holding and only blocks execution ±2 minutes in High Stakes). If you trade around events, The 5ers is more usable; if you want ThinkTrader/TradingView native and accept a full news ban, ThinkCapital fits.

FundedNext vs The 5ers — FundedNext offers multiple models including Instant funding (Stellar Instant up to 80% split), which The 5ers doesn’t mirror directly. The 5ers focuses on one-, two-, and three-step paths with unlimited time and static limits; its main constraint is the High Stakes news-execution window. Pick FundedNext if you specifically want instant models; pick The 5ers if you want static risk plus unlimited time and don’t mind stricter news execution.

Bottom Line

The 5ers is a mature prop firm with three well-differentiated programs, unlimited time, and a clear ruleset. High Stakes provides robust capital growth with strict news-execution boundaries. Hyper Growth is the single-phase option with tight daily/overall limits. Bootcamp minimizes upfront cost at the expense of a longer path. Payout logistics and method fees are transparent. If your strategy respects static drawdowns and you don’t depend on news-time entries, The 5ers is a credible option in 2026.

FAQs

Q1: Can I hold positions over the weekend?

Yes. Weekend and overnight holding are allowed across programs; be mindful of swaps on indices.

Q2: What is the news trading policy?

You can hold through news on all programs, but High Stakes bans order execution from T-2 to T+2 minutes on high-impact events; profits in that window can be removed.

Q3: Which platforms are supported?

MT5 and cTrader. The cTrader rollout was announced in 2025.

Q4: Are EAs allowed?

Yes, but not for HFT, tick-scalping, latency/hedge/reverse arbitrage, or third-party EAs without source-code ownership.

Q5: What are the payout methods and fees?

Rise, bank transfer, crypto, and Hub Credits; fees are 2% (Rise/crypto), 3% (bank), 0% (Hub Credits). $150 minimum.

Q6: How many accounts can I run?

High Stakes lists size-tier limits for simultaneous accounts; Bootcamp limits funded accounts and enforces inactivity closures after 30 days.

Q7: What are commissions/spreads like?

FX $4/lot round-trip; indices $0 commission; others percentage-based. Check the asset specification page for current details and swaps.

Q8: Is the upfront fee refundable?

High Stakes: fee is added to equity and can be withdrawn at the first 14-day payout. Bootcamp: small entry fee now, remainder upon success. Hyper Growth: not advertised as refundable.

Q9: What’s the leverage?

Headline 1:30, with asset-specific variations in the specs.