Blueberry Funded Review

Blueberry Funded launched in August 2024 and is based in Saint Vincent and the Grenadines. It’s backed by Blueberry Markets, which gives it a strong foundation right out of the gate. For traders, that backing translates into a flexible setup with room to grow, especially if you’re aiming to trade larger account sizes over time.

Being broker-backed, the trading environment is solid and well put together, rather than rushed or experimental. You get access to reliable technology and smooth execution, which goes a long way in building confidence when you’re trading real capital.

Reviewed by: Adam Niven

Fact-checked: January 2026

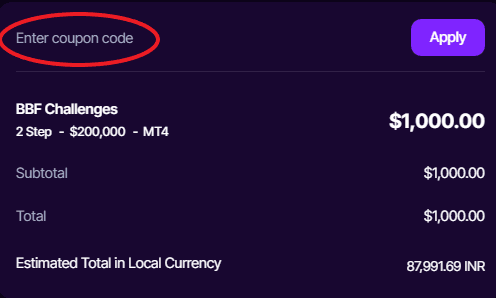

Enter promo code PROPFIRMFOREX at signup and get 20% off fees on any challenge type

Snapshot (TL;DR)

With a decade of brokerage experience behind the scenes and a clear understanding of how prop firms operate, Blueberry Funded is focused on providing dependable tools and trading conditions for top-tier performance.

Best for:

Experienced CFD day traders who want broker-backed infrastructure, raw-style spreads, and flexible programs (1 step, 2 step, Rapid, and Instant). If you trade XAUUSD, indices, or major FX with a defined edge and can respect a no-news window and lot-size caps, this is a fit.

Not for:

Complete beginners, traders chasing ultra-high leverage or instant payouts, or anyone who wants to skip an evaluation process entirely.

PROS:

Broker-backed execution + raw pricing – $7 per FX/XAU lot commission, spreads from 0.1 pips via Blueberry Markets liquidity.

Clear documentation – Up-to-date PDF outlines for 1-Step, 2-Step, and Rapid; unlimited time on most, 14-day payout cycle.

Instant accounts – Scalable to 2M (simulated capital) with up to 90% split: Instant Lite/Elite plus a scaling plan tied to payouts and profitability.

CONS:

Strict news rule – No opening/closing within ±2 minutes of high-impact releases; special Prime note. Can clip intraday edges.

Prohibited strategies list is long – e.g., Lot-size restrictions.

Not many educational resources – Minimal educational resources available.

|

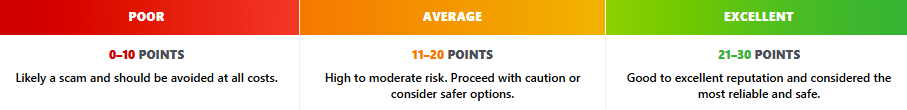

Transparency & Reputation

Clear Help Center and public outlines explain rules such as news timing and loss limits. Brand is young which tempers reputation.

|

4 |

|

Payouts & Reliability

First payout becomes available after 14 days with an optional 7-day add-on and subsequent 14-day cadence. Track record still short.

|

4 |

|

Evaluation Models

Offers Instant, 1-Step, 2-Step and 3-Step with documented targets and drawdowns which makes difficulty transparent.

|

4 |

|

Long-Term Growth

Scaling plan requires 10 percent net over three months plus four payouts which is clear though caps are not consolidated on one public page.

|

3 |

|

Value for Money

One-time fees and frequent promos reported across hubs yet fees are not refundable which reduces value for some traders.

|

3 |

|

Platforms & Support

MT4, MT5, DXtrade and TradeLocker are available with rules and symbol parameters documented for traders.

|

4 |

See Methodology page for the full breakdown of how each category is scored.

Backed by Blueberry Markets

Ensures that traders benefit from a dependable and secure trading infrastructure, raising the bar for trust and reliability in the prop trading industry.

90% Upgraded Profit Share

Traders starting with a $200k account and who meet the scaling criteria will benefit from an upgraded profit share of up to 90%.

Optional Scaling Program

Increases to funded account every 3 months if objectives are met, with trading objectives remaining the same as your original plan on increased balance.

Sustainable Evaluations

The firm offers structured and sustainable evaluation models to ensure traders are adequately prepared to handle live capital and build long-term trading success.

Challenges and Accounts

Blueberry Funded imposes a maximum simulated capital allocation of $400,000 per individual, which can be a single account or split across multiple accounts.

Prime Challenge 2 Step

You aim for eight percent in phase one. Then six percent in phase two. Daily drawdown is four percent of the initial balance. The overall drawdown is ten percent. Time is unlimited. You need five active days in each phase and three active days on the funded side before you can withdraw. FX leverage is 1 to 30. News trading is restricted and EAs are allowed within the published rules. Copy trading is limited to your own accounts.

Standard 2 Step

The targets are ten percent then five percent. Daily drawdown is five percent with a ten percent overall cap. No time limit. The minimum days are three and three in the phases and three while funded. FX leverage is 1 to 50. News is restricted. EAs are allowed if they do not fit a prohibited pattern.

1 Step

You need ten percent once to pass. Daily drawdown is four percent. Overall drawdown is six percent. No time limit. You need three active days in the evaluation and three days as a funded trader before your first withdrawal. FX leverage is 1 to 30. Same rule pack for news and EAs.

Rapid 1 Step

This is a seven day sprint. The profit target is five percent. The limits use trailing logic. Daily trailing is three percent and the overall trailing limit is four percent. The Help Center explains a lock style feature, often called a balance protector, that stops the trail from rising once the account hits a set gain level. You do not need any minimum days to pass the eval. You do need three active days during a payout cycle once funded. Copy trading is not allowed on Rapid.

Instant Lite and Instant Elite

There is no evaluation. You trade a live simulated account under set risk limits. Instant Lite uses a two percent daily static limit and a four percent trailing lock. Instant Elite has a ten percent trailing lock and no daily cap. Payout cadence is every fourteen days. Instant Lite needs three active days in a payout window. Instant Elite needs five. Copy trading between your own accounts is allowed under the Instant plan overview. The general list of prohibited strategies still applies.

Trading Platforms

You can use MT4 and MT5. You can also run DXtrade and TradeLocker. That covers most retail workflows and lets you run manual and EA setups side by side. The prop sits near the Blueberry Markets ecosystem, which is a known broker brand. That is good for pricing and platform familiarity. It does not remove market risk. Slippage will still occur around news and during thin times. The firm bans HFT and any latency or tick based approaches, so keep your code clean and away from edge hunting that depends on quotation lag.

Scaling Plan Overview

Blueberry Funded places a strong emphasis on long-term trader growth. The firm offers a scaling plan that allows you to increase your simulated capital every three months, provided you achieve at least 10% net profit across three consecutive months and complete four payouts within that period.

- Upgraded Profit Split of up to 90%

- Balance Scale up of 25% every 3 months

- Ongoing Increases every 3 months if objectives are met

- Trading Objectives remain the same as your original plan on increased balance

- Maximum Allocation per trader of $2 million

| Elapsed Time | Initial Balance |

|---|---|

| 0 months | $200,000 |

| 3 months | $250,000 |

| 6 months | $300,000 |

| 9 months | $350,000 |

| 12 months | $400,000 |

| 15 months | $450,000 |

| 18 months | $500,000 |

| 21 months | $550,000 |

| 24 months | $600,000 |

Trading Rules

Blueberry Funded sets firm trading rules to encourage responsible and sustainable practices. High-risk strategies such as Martingale, grid trading, and excessive scalping are strictly prohibited, but traders are free to use Expert Advisors (EAs) for automation and can trade over weekends.

Excessive Scalping

- More than 50% of trades are held for less than one minute.

- Includes tick scalping and high-frequency trading (HFT).

For example: If a trader executes 60 trades and 35 or more are under 45 seconds, this is a violation.

Martingale (Not Allowed)

- Increasing lot sizes after losses is prohibited (doubling down, pyramiding, switching to correlated assets with higher size).

Violations include:

- Opening a larger position after a losing trade

- Increasing lot size by 50% or more after a loss

- Creating a pattern of progressively larger positions during drawdown

- Using multiple accounts to bypass detection

- Increasing position size in correlated pairs (e.g., EURUSD → EURJPY)

Reason: Martingale strategies escalate risk exponentially and can cause catastrophic losses.

Position Stacking Limits

- Same asset pair: maximum 4 open positions.

- Across all assets: maximum 7 open positions.

Violations include:

- 5 or more positions on the same pair

- 8 or more positions across all assets

- Splitting trades to bypass lot size rules

- Repetitive opening/closing on the same asset to disguise stacking

- Grid strategies that open multiple positions beyond limits

Reason: Prevents overexposure and concentration of risk.

All-In Trading

- Committing excessive equity to one or a few trades without proper risk management (e.g., no stop-loss).

- Leads to extreme profit/loss swings and is considered gambling and a hard breach.

Grid Trading

- Placing buy and sell orders at predetermined intervals without a clear risk management plan.

Example: Buying AUD/USD at 0.6700, 0.6720, 0.6740 and selling at 0.6680, 0.6660, 0.6640.

Reverse Hand Post Losses

- Entering a trade in the opposite direction immediately after closing a losing trade. Minimum wait time required: 5 minutes before reversing.

- Violations can result in a reset to Phase 1, denial of payout, or termination depending on risk profile.

General Notes

A trade = one position on a specific pair (multiple entries at the same time may count as one).

Use of prohibited strategies will prevent advancement to funded stage. If used on an earnings account, payout is denied and account reverts to Phase 1. Instant Funding accounts: No warnings. Any violation results in termination, intentional or not.

For more details on Blueberry Funded’s trading policy, please check out their Trading Rules & Guidelines page.

Payouts and Reliability

The first payout becomes available fourteen days after you get funded. After that, the cadence is every fourteen days by default. There is a seven day payout add on you can purchase when you buy your challenge. That add on changes the cadence for eligible accounts. Payouts are processed through crypto rails and through Rise. This is all written in the public outline and in the Help Center.

What about the track record. The brand is new compared with the old names. The Trustpilot pages show a four star range with a large number of recent comments. Some talk about fast service and clean dashboards, others call out slower replies during busy periods. Treat public reviews as a flavor, not hard data. They are useful to read, yet they are not a substitute for your own risk checks. Large review sites fight spam and manipulation and that risk is real in the wider industry.

My take. Reliability is building. The docs are clear and the internal tooling is visible in the dashboard and the Help Center. I mark this as medium until we see more calendar time.

Commission Fees

Blueberry Funded offer raw spreads starting as low as 0.1 pips. A commission of USD $7 per standard lot is charged on FX currency pairs. Commissions and spreads are marketed as raw style. You will see tight metals and major FX pairs. Stocks and some indices show distinct commission settings. Always check the symbol list in your dashboard because the cost stack can vary by instrument and by platform. If you are an EA trader, hard code your minimum spread filter and your max slippage. Then do a dry pass on demo before you size up.

Payment Methods

Blueberry Funded supports both cryptocurrency and bank transfers for challenge fee payments. Crypto transactions carry a 1% fee, and bank transfers are processed via Unified Payments Interface (UPI).

The process for making a payment on either platform is documented on their website:

How to make Payment using UPI

How to make Payment using Crypto

Community and Trust

One of the biggest trust signals for Blueberry Funded is its record of verified trader payouts, which demonstrates that the firm delivers on its promises. Backed by Blueberry Markets, an ASIC-regulated broker, the firm provides traders with the confidence that payouts are both legitimate and secure.

Support

Support is available through email and chat. Coverage is effectively always on, with typical live chat hours covering all trading days. Response time can vary. Trustpilot comments show both quick replies and the occasional day long wait, which is normal when volume spikes. If you need an urgent answer about a rule and the market is moving, use the Help Center first because the articles are specific and short.

Blueberry Funded Leadership

Marcus Fetherston is the General Manager of Blueberry Funded.

His background in the financial sector includes several leadership roles. Prior to joining Blueberry Funded in August 2024, he was the Director and Chief Product Officer at PropTradeTech, a Melbourne-based firm focused on trading technology, from 2023 to 2024. Before that, he held the position of Director of Operations at Eightcap, another financial firm in Melbourne, from 2020 to 2023. He also worked at Pepperstone, where he advanced through roles from Operations Officer to Operations Team Lead between 2017 and 2020.

At Blueberry Funded, Fetherston emphasizes the firm’s commitment to innovation and supporting traders with up to $400,000 in simulated capital and access to popular trading platforms like MT4, MT5, and DX Trade. He has also contributed to industry discussions, such as his participation in a panel at the Finance Magnates London Summit 2023, where he spoke about the convergence of prop trading and retail brokerage services.

How Blueberry Funded Compares With Other Firms

Compared to DNA Funded

DNA Funded, also tied to a broker, has gained attention for its low fees and fast evaluation processes. Blueberry Funded shares this broker-backed approach but distinguishes itself with Blueberry Markets’ established reputation in the forex industry. DNA Funded may be better for cost-conscious traders, while Blueberry Funded stands out for traders seeking a balance of credibility, execution speed, and growth opportunities.

Compared to FundedNext

FundedNext has grown quickly thanks to its flexible evaluation models and generous profit split options. Blueberry Funded, while newer, focuses on trust through its direct connection with Blueberry Markets, an ASIC-regulated broker. Traders seeking a larger, well-marketed firm might lean toward FundedNext, while those who prioritize regulatory backing and reliability may prefer Blueberry.

Compared to ThinkCapital

ThinkCapital is another emerging player offering funded accounts with competitive profit splits and trading rules. Compared to ThinkCapital, Blueberry Funded benefits from its broker foundation, which ensures tighter spreads and execution. ThinkCapital may appeal to those looking for innovative funding options, while Blueberry appeals to traders who want the security of a broker-regulated structure.

Compared to FTMO

Blueberry Funded positions itself as a competitive broker-backed prop firm, while FTMO has long been the industry leader with a proven track record. FTMO offers a slightly more established community and global recognition, but Blueberry Funded appeals to traders who value direct broker support and faster execution speeds. Both firms deliver high-quality platforms, though FTMO’s stricter rules contrast with Blueberry’s more flexible trading conditions.

Compared to The 5ers

The 5ers focuses heavily on low-risk, long-term capital growth, making it ideal for conservative traders. Blueberry Funded, on the other hand, offers more aggressive scaling opportunities and faster access to funded accounts. Traders looking for gradual growth and security may prefer The 5ers, while those wanting higher profit potential with broker-backed support may find Blueberry more appealing.

Compared to Funded Trading Plus

Funded Trading Plus emphasizes trader-friendly rules with unlimited trading days and multiple program structures. Blueberry Funded offers a similar trader-first model but stands out with its strong brokerage backing and faster trade execution. Both firms are accessible to beginners and professionals, but Blueberry may have the edge for traders who prioritize execution quality and broker transparency.

Bottom Line

Blueberry Funded is a clean and modern prop backed by a known broker setup. The rules are clear. The payout cycle is easy to plan around. The strict parts are news timing and the list of banned strategies. If your edge is not built on news or latency and you prefer raw style pricing on familiar platforms, this is a strong option. If you want the longest track record or the softest enforcement, pick a different shop.

FAQs

Is news trading allowed?

Not for new entries or closures that fall within two minutes before or after a high impact event. You may manage risk on open positions and TP or SL can be hit at any time.

When can I request my first payout?

Fourteen days after funding. The default cadence is every fourteen days after that. There is a seven day payout add on at checkout for eligible accounts.

Are EAs allowed?

Yes, with limits. The Help Center bans HFT, latency or tick based arbitrage, and similar practices. Review the prohibited strategies page before you automate.

Can I hold over the weekend?

Yes in general. As always you carry gap risk. The rules page explains weekend and overnight holding.

What leverage can I use?

Typically 1 to 30 on FX for 1 Step and Prime, and 1 to 50 on the standard 2 Step. Indices and metals show 1 to 10. Crypto is 1 to 2. Check the outline for the exact figure by plan.

How does scaling work?

The site states a three month cycle. You need at least ten percent net profit over three consecutive months and at least four payouts within that window. Meet those and you can move to a higher simulated allocation.

How many active days do I need for payout?

Three active days in most plans. Instant Elite uses five. Your dashboard will show the counter for the current cycle.

Which payout methods are available?

Crypto and Rise are supported. The in app flow explains the steps.

Are fees refundable?

No. The program does not advertise refundable fees. Buy only after you check the rules and your jurisdiction status.

Is copy trading allowed?

Copy between your own accounts is generally allowed, except Rapid which bans it. Copying from third parties is not allowed. See the plan page and the copy trading article in the Help Center.

How to Apply Promo Code

Visit the Blueberry Funded website and select your preferred challenge or funding program.

During checkout, locate the field labeled “Enter Coupon” and paste our exclusive coupon code and click “Apply”.

Confirm that the discount has been applied before completing your purchase.

If you experience an issue with the coupon code, or have any questions, feel free to reach out to us at contact@propfirmforex.com.

Would You Pass a Prop Firm Challenge?

Take a quick self-assessment to see how closely your trading habits and mindset align with typical prop firm requirements, and get an idea of how likely you are to pass an evaluation and move on to a funded account.