Advanced trading platforms like MetaTrader and TradingView offer powerful features that enable traders to execute strategies with precision, analyze market data in depth, and automate their trading to gain an edge. For prop traders, mastering these platforms is essential for staying ahead of the competition.

In this post, we’ll dive into the key features of advanced trading platforms, explain how to use them effectively, and provide practical advice for integrating them into your trading routine. Whether you’re a seasoned trader or just getting started, understanding how to leverage these platforms can elevate your trading performance.

Why Advanced Trading Platforms Matter for Traders

Trading in the market requires quick decision-making, real-time data analysis, and efficient trade execution. Advanced trading platforms, such as MetaTrader (MT) and TradingView (TV), are designed to meet these needs by offering a suite of tools that go beyond basic charting and order placement.

Key Benefits of Using Advanced Trading Platforms

Enhanced Analysis: Access to advanced charting tools, technical indicators, and drawing tools for detailed market analysis.

Automated Trading: Use of expert advisors (EAs) and scripts to automate trading strategies and reduce manual intervention.

Customizability: Ability to customize your trading workspace, create custom indicators, and set up alerts for real-time market updates.

Example: A prop trader using MT5 can automate a trend-following strategy with an expert advisor, while simultaneously using TradingView’s advanced charting tools to conduct in-depth technical analysis.

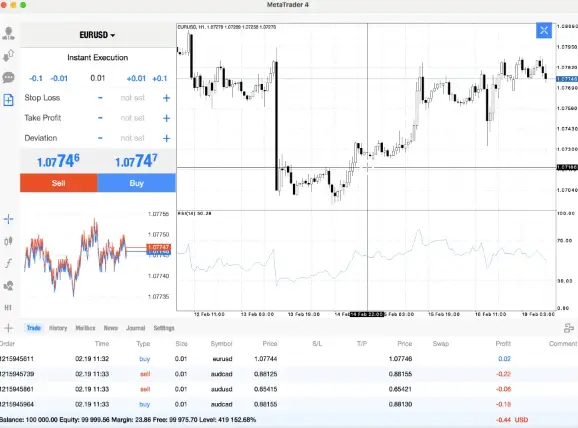

Exploring MetaTrader: A Powerful Trading Tool for Traders

MetaTrader (MT4 and MT5) is one of the most widely used trading platforms in the world. Known for its robust features, MetaTrader offers traders everything they need to execute trades, analyze markets, and automate strategies.

Key Features of MetaTrader

MetaTrader’s key features make it a go-to platform for traders looking for advanced functionality. Here’s a breakdown of the core features:

Advanced Charting Tools: MT provides various chart types (candlestick, bar, and line charts), along with the ability to add technical indicators, trendlines, and Fibonacci retracement levels directly onto the charts.

Custom Indicators and Scripts: Traders can create or import custom indicators to suit their trading strategies, allowing for more personalized analysis.

Expert Advisors (EAs): The automated trading feature in MT5 allows traders to use EAs to execute trades based on predefined conditions, freeing them from manual trading and reducing the risk of emotional decisions.

Backtesting: MT5 offers a strategy tester where traders can backtest their EAs using historical data, helping them refine their strategies before going live.

How to Use MT5 Effectively

To get the most out of MT5, it’s essential to understand how to leverage its key features effectively. Here are some tips for optimizing your experience:

Customize Your Workspace: Take advantage of MetaTrader’s customizable workspace by setting up your preferred chart layouts, timeframes, and indicators. Save your templates to quickly switch between different setups.

Utilize EAs for Automation: If you have a well-defined strategy, consider automating it with an expert advisor. This allows you to execute trades even when you’re not actively monitoring the market.

Backtest Your Strategies: Use MetaTrader’s strategy tester to backtest your trading strategies on historical data. This helps you identify potential weaknesses and optimize your approach before trading live.

Example: A trader using MT might create a custom EA to trade a moving average crossover strategy automatically. They can backtest the EA on historical data to ensure it performs well under different market conditions before deploying it in live trading.

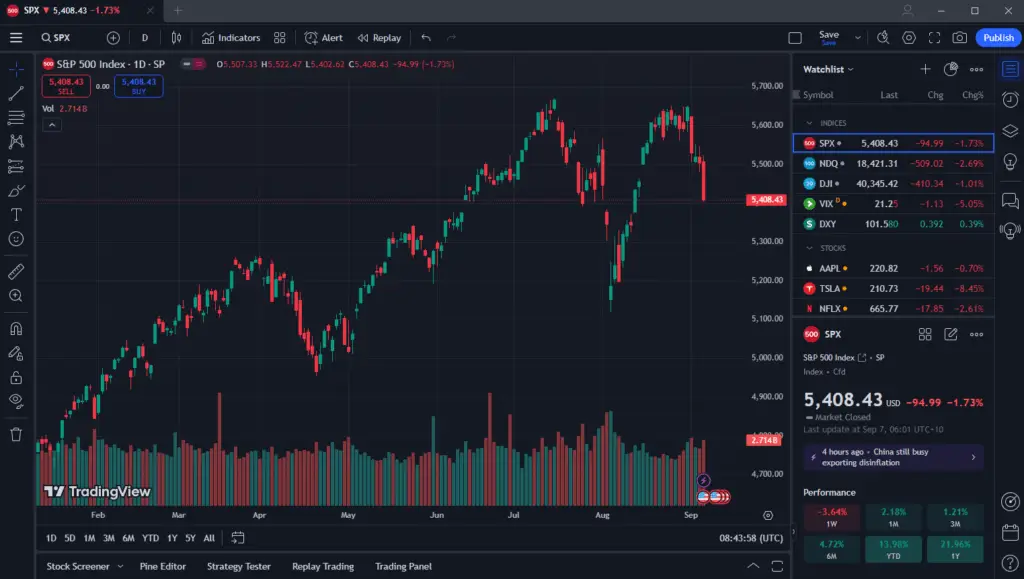

Exploring TradingView: Advanced Charting and Analysis for Traders

TradingView is a web-based trading platform known for its advanced charting capabilities, extensive market data, and social trading features. For traders who prioritize technical analysis, TV offers a comprehensive set of tools to analyze the market.

Key Features of TradingView:

TradingView’s intuitive interface and powerful features make it a favorite among traders who want advanced charting tools and real-time market data. Here are some of the platform’s standout features:

Advanced Charting and Drawing Tools: TV offers a wide range of chart types and drawing tools, including trendlines, pitchforks, and Fibonacci retracements. You can also overlay multiple indicators and customize your charts with ease.

Custom Scripts with Pine Script: TV’s proprietary scripting language, Pine Script, allows traders to create custom indicators and strategies. This is particularly useful for traders who want to develop and test their own technical indicators.

Social Trading Community: Social features enable traders to share ideas, charts, and strategies with a global community. You can follow other traders, comment on their ideas, and get inspiration from the broader trading community.

Real-Time Alerts: TV allows traders to set real-time alerts based on price levels, indicator conditions, or custom scripts. This helps you stay on top of market movements without constantly monitoring your screen.

How to Use TradingView Effectively

To make the most of TradingView’s advanced features, here are some practical tips for optimizing your experience:

Leverage Custom Scripts: If you have specific technical analysis needs, consider creating your own indicators or strategies using Pine Script. This gives you the flexibility to tailor TV to your unique trading style.

Set Alerts for Key Levels: Use TV’s alert system to notify you of important price movements or indicator signals. This ensures that you never miss a trading opportunity, even if you’re away from your screen.

Engage with the Community: Take advantage of TV’s social features by following top traders, learning from their strategies, and engaging in discussions. This can provide valuable insights and help you refine your approach.

Example: A trader using TV might set up custom indicators to track market momentum and create alerts for when a currency pair hits key resistance or support levels. This allows them to act quickly on potential trade setups.

Combining MetaTrader and TradingView for Maximum Impact

While both MT and TV are powerful platforms on their own, combining them can give traders a significant advantage. Here’s how you can integrate both platforms into your trading routine:

Use TradingView for Analysis, MetaTrader for Execution

TradingView’s advanced charting and analysis tools make it ideal for conducting detailed market analysis. Once you’ve identified a trade setup on TradingView, you can execute the trade on MetaTrader, where you can take advantage of automation and advanced order types.

Tip: Conduct your technical analysis on TV, using its powerful charting tools to identify trade opportunities. Then, switch to MT to execute your trades and manage your positions using EAs and scripts.

Backtest Strategies on MT, Refine on TV

Use MT’s backtesting feature to test your strategies on historical data. Once you’ve refined your strategy, use TV’s charting tools to fine-tune your entry and exit points based on real-time data.

Tip: If you create a custom indicator in Pine Script on TV, consider backtesting it on MT to see how it performs under different market conditions.

Conclusion

Advanced trading platforms like MT and TV offer prop traders the tools they need to analyze markets, execute trades, and automate strategies with precision. By mastering these platforms and using them together, you can enhance your trading performance, make more informed decisions, and gain a competitive edge.